Stock Market Trends and Predictions: The stock market is a dynamic ecosystem where investors seek opportunities to generate wealth through buying and selling shares of publicly traded companies. However, predicting stock market trends accurately can be a daunting task, as it is influenced by a multitude of factors ranging from economic indicators to geopolitical events. In this article, we will explore the current stock market trends and make some predictions to assist investors in navigating the ever-changing landscape.

I. Understanding the Current Stock Market Trends and Predictions

A. Economic Indicators and Market Sentiment

- GDP Growth and Employment Rates

- Consumer Confidence and Spending Patterns

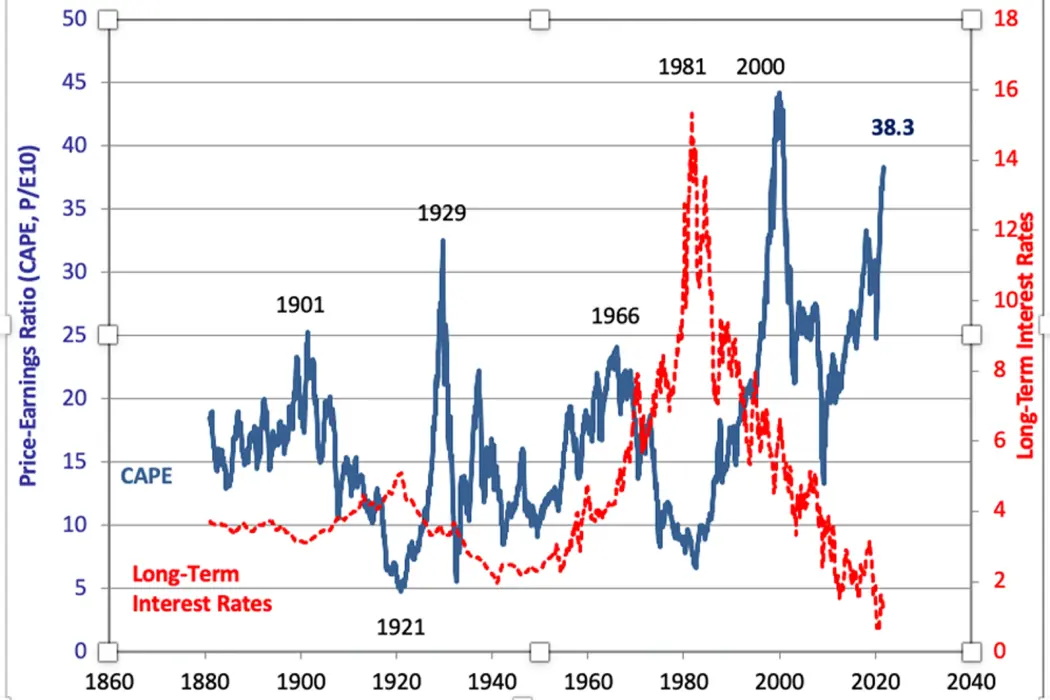

- Interest Rates and Monetary Policy

B. Technological Advancements and Sector Performance

- Digital Transformation and Tech Stocks

- Renewable Energy and Sustainability

- Healthcare and Biotech Innovations

II. Stock Market Trends and Predictions for the Future

A. Evolving Work Models and Remote Collaboration

- Rise of Remote Work Technology Stocks

- Impact on Commercial Real Estate Sector

B. Climate Change and Sustainable Investments

- Continued Growth of Renewable Energy Stocks

- ESG Investing and Corporate Social Responsibility

C. Emerging Technologies and Their Influence

- Artificial Intelligence and Automation

- Blockchain and Cryptocurrencies

III. Risks and Challenges to Consider

A. Geopolitical Tensions and Trade Wars

- Impact on Global Supply Chains

- Tariffs and Trade Barriers

B. Inflation and Rising Interest Rates

- Effect on Borrowing Costs and Corporate Profits

- Equity Valuations and Market Corrections

C. Regulatory Changes and Compliance

- Antitrust Scrutiny on Big Tech Companies

- Government Intervention in Specific Industries

IV. Strategies for Successful Investing

A. Diversification and Risk Management

- Asset Allocation and Portfolio Rebalancing

- Hedging Techniques and Options Trading

B. Long-Term Investing vs. Short-Term Trading

- Fundamental Analysis and Value Investing

- Technical Analysis and Market Timing

C. Staying Informed and Adapting to Change

- Continuous Learning and Research

- Staying Abreast of Market News and Events

The stock market is a constantly evolving landscape, influenced by a myriad of factors. Understanding the current trends and making accurate predictions can be challenging, but by assessing economic indicators, technological advancements, and potential risks, investors can navigate the market more effectively. Employing strategies such as diversification, risk management, and staying informed can enhance investment outcomes. However, it is important to remember that even with careful analysis, the stock market remains inherently unpredictable. By adopting a long-term perspective and being adaptable, investors can better position themselves to capitalize on opportunities and weather any storms that may arise in this dynamic environment.

Read Also: How to Read Stock Charts

![]()