What is a Blue-Chip Stock: Blue-chip stocks are often considered the crème de la crème of the stock market. These are shares in large, well-established companies with a reputation for stability, reliability, and strong financial performance. They are typically companies that have been around for many years, have a proven track record of success, and are leaders in their respective industries. In this article, we will explore what a blue-chip stock is, why they are considered a safe investment, and some examples of blue-chip stocks.

What is a Blue-Chip Stock?

Blue-chip stocks are shares in large, established companies that are known for their financial stability and strong market position. These companies are often leaders in their industries and have a track record of steady growth and profitability. They are also typically companies that have been around for many years and have a strong reputation for quality products or services.

The term “blue-chip” is believed to have originated in the early 20th century, when poker players used blue-colored chips to represent the highest-value chips in the game. Today, the term is widely used to describe stocks that are considered to be of the highest quality and are perceived as being safe investments.

Why are Blue-Chip Stocks Considered a Safe Investment?

Blue-chip stocks are considered a safe investment for several reasons. Firstly, they are typically companies that have a long track record of success and have weathered multiple economic cycles. As a result, they are often able to withstand market fluctuations and continue to generate profits even during challenging economic times.

Secondly, blue-chip stocks are often leaders in their respective industries, which means they have a strong competitive advantage. This can come in the form of brand recognition, intellectual property, or economies of scale. These factors can help protect the company’s market position and ensure that it continues to generate profits over the long term.

Finally, blue-chip stocks are often companies that pay regular dividends to their shareholders. This can provide investors with a steady stream of income, even during times when the stock market is volatile. It also means that investors can benefit from the compounding effect of reinvesting dividends over the long term.

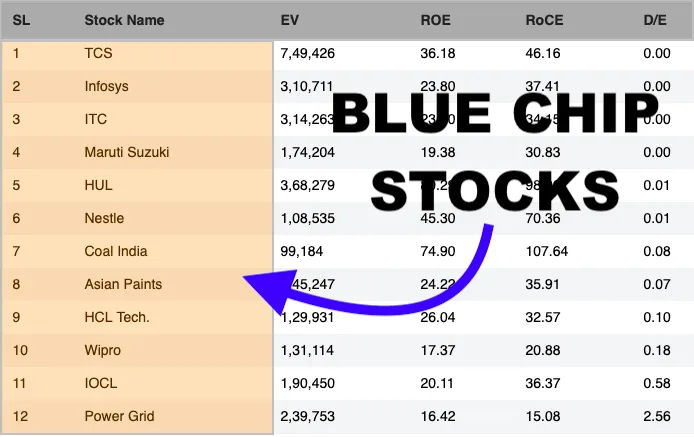

Examples of Blue-Chip Stocks

There are many blue-chip stocks to choose from, but here are a few examples:

- Apple Inc. – Apple is one of the world’s largest technology companies, known for its popular iPhone, iPad, and Mac products. It has a market capitalization of over $2 trillion and is consistently ranked as one of the most valuable companies in the world.

- Microsoft Corporation – Microsoft is another technology giant, best known for its Windows operating system and Office productivity suite. It has a market capitalization of over $2 trillion and is a leader in the software industry.

- Johnson & Johnson – Johnson & Johnson is a multinational healthcare company that produces a range of consumer health products, medical devices, and pharmaceuticals. It has a market capitalization of over $400 billion and is known for its strong brand and steady growth.

- Procter & Gamble – Procter & Gamble is a consumer goods company that produces a wide range of household and personal care products. It has a market capitalization of over $300 billion and is known for its well-known brands such as Tide, Pampers, and Gillette.

- Coca-Cola Company – Coca-Cola is a beverage company that produces a range of soft drinks, juices, and other beverages. It has a market capitalization of over $200 billion and is known for its strong brand and global reach.

Blue-chip stocks are a popular choice for investors who are looking for a safe and reliable investment option. These are shares in large, well-established companies that have a proven track record of success and are leaders in their respective industries.

Read Also: How to Invest in the Stock Market

![]()