Stock Market Crash/Corrections: The stock market has long been a hotbed of volatility, showcasing its unpredictable nature through periodic corrections and occasional crashes. These events, though unsettling, are an inherent part of the market’s cyclical nature. Understanding the causes and consequences of stock market corrections and crashes is crucial for investors, as it equips them with the knowledge needed to navigate the stormy seas of the financial world.

I. What are Stock Market Crash/ Corrections?

A. Defining Stock Market Crash/ Corrections:

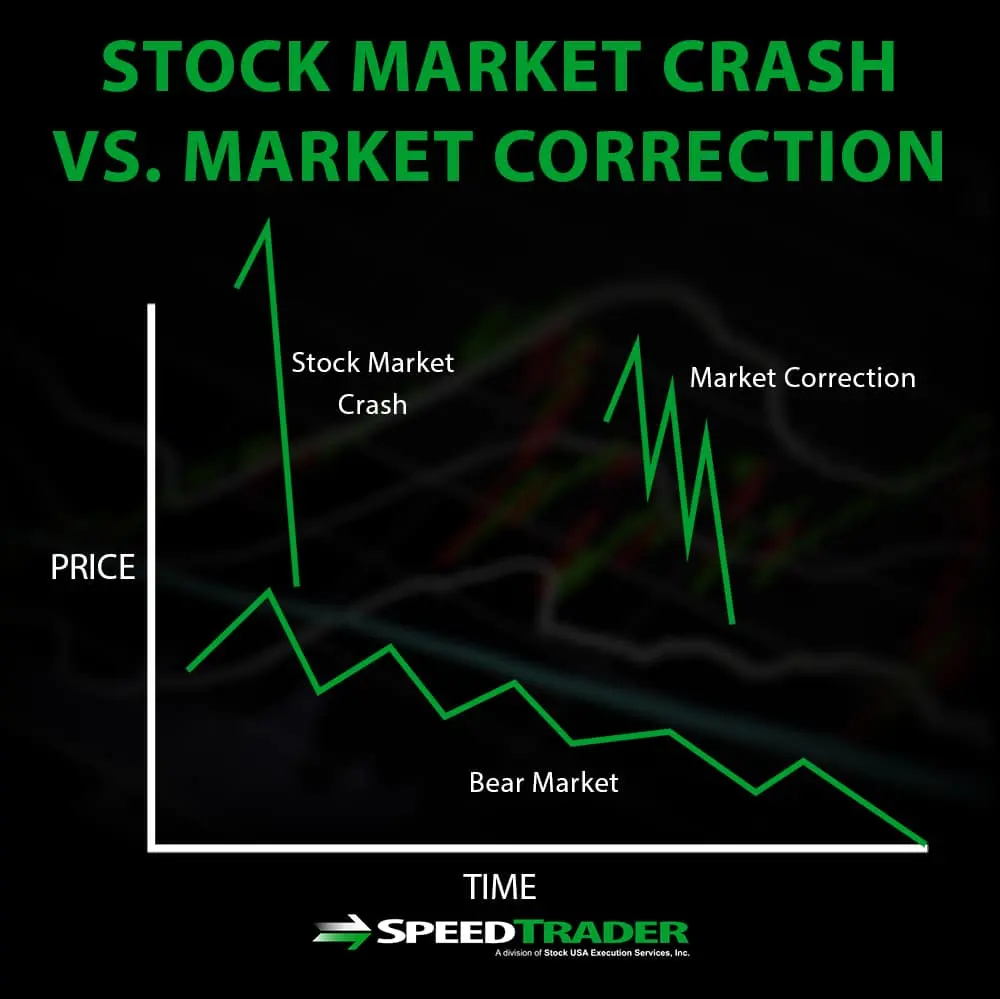

A stock market correction occurs when the overall market experiences a decline of 10% or more from its recent peak. Corrections are considered healthy and natural adjustments to the market’s overvaluation, usually resulting from a variety of factors such as economic indicators, geopolitical events, or investor sentiment.

B. Causes of Stock Market Crash/ Corrections:

- Economic Factors:

- Economic slowdown or recession.

- Changes in interest rates.

- Inflationary pressures.

- Market Sentiment:

- Fear of a bubble or overvaluation.

- Investor uncertainty and panic selling.

- Negative news affecting market confidence.

C. Duration and Impact of Stock Market Crash/Corrections:

Stock market corrections are generally short-lived, with durations ranging from a few weeks to several months. The impact on investors varies depending on their investment strategy and risk tolerance. Long-term investors often view corrections as buying opportunities, as prices tend to be lower during these periods.

II. Understanding Stock Market Crash/Corrections:

A. Defining Stock Market Crashes:

Stock market crashes are more severe than corrections and are characterized by rapid and significant declines in stock prices, resulting in a loss of investor confidence. These events are often accompanied by a widespread economic downturn and can have far-reaching consequences.

B. Causes of Stock Market Crashes:

- Speculative Bubbles:

- Excessive speculation and irrational exuberance.

- Overvaluation of stocks, leading to a sudden burst of the bubble.

- Systemic Shocks:

- Major geopolitical events (e.g., wars, political instability).

- Financial crises or banking failures.

- Natural disasters with significant economic implications.

C. Duration and Impact of Stock Market Crash/Corrections:

Stock market crashes can last for an extended period, sometimes years, as economies struggle to recover from the aftermath. The impact on investors can be severe, resulting in substantial losses and financial distress. Crashes often lead to economic recessions and unemployment, affecting both individual investors and businesses alike.

III. Coping Strategies for Investors with Stock Market Crash/ Corrections:

A. Preparing for Volatility:

- Diversification:

- Spreading investments across various asset classes and sectors.

- Reducing the risk of significant losses in a particular stock or sector.

- Risk Management:

- Setting realistic investment goals and time horizons.

- Regularly reviewing and rebalancing investment portfolios.

- Implementing stop-loss orders to limit potential losses.

B. Maintaining a Long-Term Perspective:

- Avoiding Emotional Decision-Making:

- Resisting the urge to panic sell during market downturns.

- Staying focused on long-term investment objectives.

- Capitalizing on Opportunities:

- Identifying undervalued stocks during market corrections.

- Accumulating quality assets at discounted prices.

C. Seeking Professional Guidance:

- Consult Financial Advisors:

- Seeking advice from experienced professionals.

- Evaluating investment strategies and risk management techniques.

- Staying Informed:

- Keeping up-to-date with market trends and economic indicators.

- Attending investment seminars and educational programs.

While stock market corrections and crashes may generate anxiety and uncertainty, they are not insurmountable challenges for knowledgeable investors. Understanding the causes and implications of these events is crucial for managing investment portfolios effectively. By adopting prudent strategies, maintaining a long-term perspective, and seeking professional guidance, investors can weather the storm and capitalize on opportunities presented by market volatility. Remember, it is often in the midst of chaos that new fortunes are made.

Read More: Initial Public Offerings (IPOs)

![]()

One thought on “Stock Market Crash/Corrections”