In the changing world of investing, one golden rule is diversification — spreading your investments across a variety of assets to reduce risk. While there are many ways to diversify, mutual funds offer a convenient and efficient way for both novice and experienced investors to achieve this goal. Mutual funds stand out as a powerful tool for portfolio diversification.

Built-in Diversification

A major advantage of mutual funds is their inherent diversification. A single mutual fund can include dozens or even hundreds of individual securities — stocks, bonds, or other assets — depending on the fund’s objective. This means that when you invest in a mutual fund, your money is automatically spread across a wide range of assets, reducing your exposure to the poor performance of any single investment.

Professional Management

Mutual funds are managed by experienced fund managers who actively monitor the market and adjust holdings in line with the fund’s objectives. These professionals conduct in-depth research and analysis on your behalf to help you make informed investment decisions, which can be a huge advantage if you lack the time or expertise to manage your own investments.

Access to a Wide Variety of Asset Classes

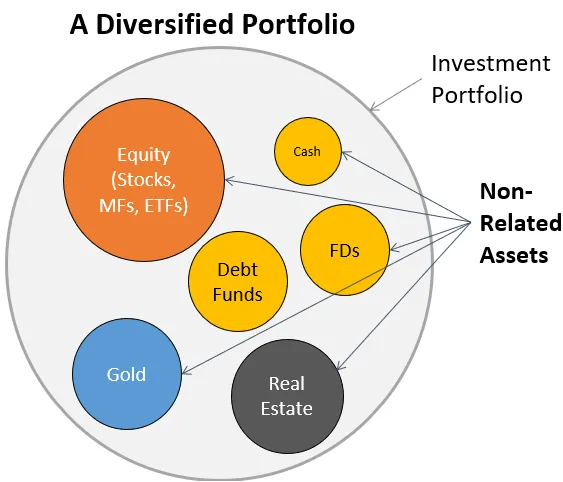

With mutual funds, investors can access a wide range of asset classes, including domestic and international stocks, government and corporate bonds, real estate, and more. This diversification helps you diversify not only across companies, but also across industries and regions, which can help protect your portfolio from local economic downturns.

Affordable Costs and Benefits

While investing in individual stocks or bonds can require significant capital, mutual funds help you diversify with a relatively small initial investment. Many funds have low minimum investment requirements, and you can often invest in a fraction of the underlying securities. This makes it easy to build a diversified portfolio, even if you’re just starting out.

Liquidity

Mutual funds are generally easy to buy and sell, providing daily liquidity. This means you can access your money relatively quickly if needed, unlike some investments that can tie up your capital for long periods of time.

Risk Reduction

Diversification is an important risk management strategy, and mutual funds make it easy to implement. By spreading your investments across a variety of asset classes, mutual funds help reduce the risk that poor performance in any one investment will significantly impact your overall portfolio.

Reinvestment Options

Many mutual funds offer automatic reinvestment of dividends and capital gains, which can accelerate the growth of your investments through the power of compounding. This feature helps your money work harder in the long run.

Mutual funds are a smart, practical way to diversify your investment portfolio. They offer professional management, access to a wide range of assets, and the convenience of investing in multiple securities at once. Whether you are a beginner or an experienced investor, mutual funds can play an important role in helping you manage risk and achieve your long-term financial goals.

Read Also: A Beginner’s Guide to Investing in Mutual Funds

![]()