Introduction:

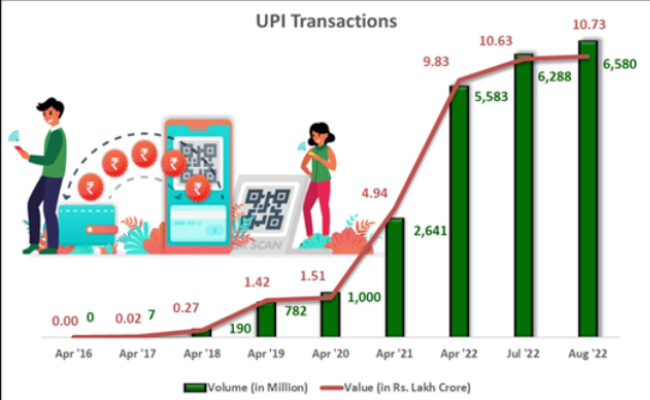

The Unified Payments Interface (UPI) is a payment system that enables instant fund transfers between bank accounts using a mobile device. UPI was launched in 2016 and has since become one of the most popular payment systems in India. The UPI system is free, fast, and seamless, making it an attractive option for businesses and consumers. In this article, we will discuss the current status of UPI and how it is benefiting the Indian economy.

Free:

One of the key features of UPI is that it is a free payment system. Unlike traditional payment methods that charge fees for transactions, UPI does not charge any fees for fund transfers. This makes it a cost-effective option for businesses and consumers who want to save money on transaction fees. Moreover, the absence of transaction fees has encouraged more people to adopt UPI, which has helped in the growth of digital payments in India.

Fast:

UPI enables instant fund transfers between bank accounts, making it a fast payment system. With UPI, transactions are processed in real-time, which means that the money is transferred immediately. This is a significant advantage over traditional payment methods like bank transfers and cheque payments, which can take several days to process. The fast processing time of UPI has made it a popular payment system among businesses and consumers who value speed and convenience.

Seamless:

UPI is a seamless payment system that can be used by anyone with a mobile device and a bank account. To use UPI, all you need to do is download a UPI-enabled app, link your bank account, and create a UPI ID. Once you have done this, you can start using UPI to make payments and transfers. UPI is interoperable, which means that you can use it to transfer funds between different banks and payment systems. The seamless nature of UPI has made it a popular payment system in India, where it has become an essential tool for businesses and consumers.

Benefits to the Indian Economy:

UPI has been a game-changer for the Indian economy, with its benefits being felt across different sectors. One of the biggest benefits of UPI is that it has helped in the growth of digital payments in India. Since UPI is a free, fast, and seamless payment system, it has encouraged more people to adopt digital payments, which has reduced the dependence on cash-based transactions. The growth of digital payments has also helped in reducing corruption and promoting financial inclusion.

UPI has also helped in promoting entrepreneurship and innovation in India. With the rise of UPI-enabled businesses, more entrepreneurs are exploring new business models that leverage the power of UPI. This has led to the emergence of new business models, such as UPI-based lending, which is helping in promoting financial inclusion in the country.

Conclusion:

UPI is a free, fast, and seamless payment system that has become an essential tool for businesses and consumers in India. The benefits of UPI are being felt across different sectors, with its impact being felt on the growth of digital payments, entrepreneurship, and innovation in the country. As UPI continues to evolve and expand, it is expected to play an even more significant role in shaping the future of the Indian economy.

![]()