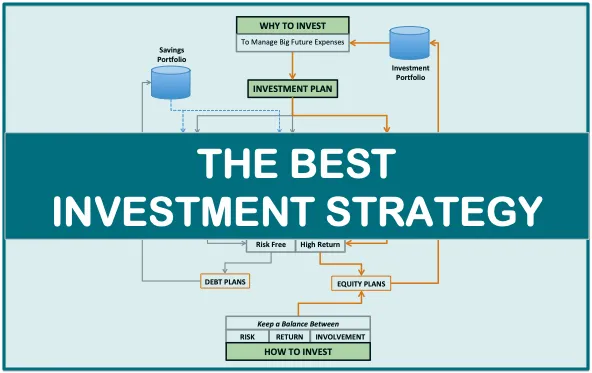

Creating a successful investment plan is an important step toward achieving your financial goals, whether it’s saving for retirement, funding a child’s education, or building wealth. A well-structured investment plan helps you stay focused, make informed decisions, and navigate the complexities of the financial markets.

Step 1: Determine your financial goals

The first step in creating your investment plan is to clearly define your financial goals. Consider the following questions:

- What are you investing for? Common goals include retirement, buying a home, starting a business, or financing education.

- What is your time horizon? Decide how long you want to invest. Short-term goals may require different strategies than long-term goals.

- What amount do you need to achieve your goals? A target figure will help you determine how much you need to invest and the potential return you need.

Step 2: Assess your risk tolerance

Understanding your risk tolerance is essential to formulating your investment strategy. Risk tolerance refers to your ability and willingness to tolerate fluctuations in the value of your investment. Things to consider include:

- Time horizon: The longer your investment horizon, the more risk you can generally take, as you have time to recover from market downturns.

- Financial Situation: Assess your income, expenses, and existing savings. A stable financial situation may allow you to take more risks.

- Emotional factors: Consider how comfortable you are with market volatility. If price fluctuations stress you out, you may prefer a more conservative approach.

Step 3: Select the right investment vehicle

Once you’ve defined your goals and assessed your risk tolerance, it’s time to select the appropriate investment vehicle. Common options include:

- Stocks: Investing in individual companies offers high return potential but also carries high risk.

- Bonds: Fixed-income securities can provide steady income and are generally considered less risky than stocks.

- Mutual Funds and ETFs: These pooled investment options allow you to invest in a diversified portfolio of assets, reducing risk.

- Real Estate: Investing in property can provide both income and potential appreciation over time.

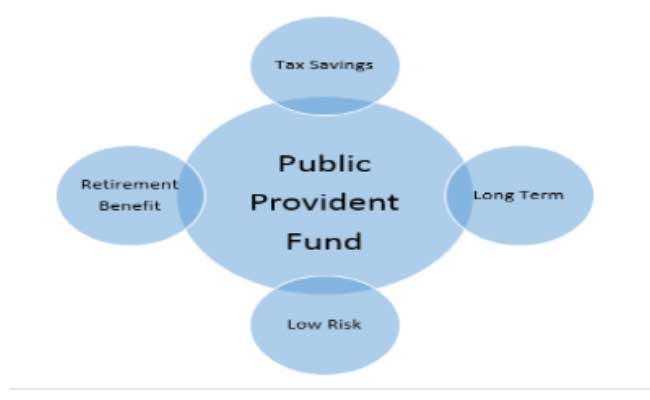

- Retirement accounts: Consider tax-advantaged accounts like 401(k)s or IRAs to boost your long-term savings.

Step 4: Diversify your portfolio

Diversification is a key principle in risk management. By spreading your investments across different asset classes, sectors, and geographies, you can reduce the impact of poor-performing investments on your overall portfolio. A diversified portfolio may include:

- Combine different asset classes: stocks, bonds, real estate, and other assets.

- Diversified sectors: Invest in multiple industries to avoid overexposure to a single sector.

- International Investments: Consider global markets to further diversify.

Step 5: Create an investment schedule

Establishing a regular investment schedule can help you stay disciplined and take advantage of market fluctuations. Consider:

- Dollar-Cost Averaging: This strategy invests a fixed amount of money at regular intervals regardless of market conditions. It reduces the impact of volatility by buying fewer shares when the price is low and buying more when the price is high.

- Rebalancing: Periodically review your portfolio and adjust your allocations to maintain your desired risk level and investment strategy. This may involve selling assets that are performing well and buying those that are lagging.

Step 6: Monitor and adjust your plan

Investment planning is not a one-time event; This requires ongoing monitoring and coordination. Regularly review your portfolio and performance against your goals:

- Track progress: Assess whether you’re on track to meet your financial goals. If not, consider adjusting your strategy or contribution.

- Stay Informed: Be aware of market trends, economic conditions, and any changes in your financial situation that may require adjustments to your investment plan.

- Avoid taking emotional decisions: Stick to your plan and avoid taking emotional decisions based on short-term market fluctuations.

Step 7: Seek professional guidance

If you feel overwhelmed or unsure about creating an investment plan, consider seeking professional advice. Financial advisors can provide personalized insights, help you develop a comprehensive investment strategy, and guide you through the intricacies of the market.

Creating a successful investment plan is a fundamental step toward achieving your financial objectives. By defining your goals, assessing your risk tolerance, selecting the right investment vehicle, diversifying your portfolio, and regularly monitoring your progress, you can create a strategy that is in line with your financial aspirations. Remember, patience and discipline are key; Successful investing is a marathon, not a sprint. Whether you’re a novice investor or a seasoned professional, taking the time to develop and execute a solid investment plan will put you on the path to financial success.

Read Also: Dividend Investing Tips

![]()