Apple Inc. is one of the largest technology companies in the world, known for its iconic products such as the iPhone, iPad, and MacBook. Apple is also a publicly traded company and its stock is widely followed by investors around the globe. In this article, we will explore the history and current state of Apple’s stock, as well as the factors that impact its price.

History of Apple Stock

Apple went public in 1980, selling 4.6 million shares at a price of $22 per share. By the end of the first day of trading, the stock had risen to $29 per share, valuing the company at $1.2 billion. Over the next two decades, Apple experienced its ups and downs, with stock prices reaching their peak in the late 1990s before bottoming out in the early 2000s.

In 2007, Apple launched the iPhone, which became a game-changer for the company and the technology industry as a whole. Apple’s stock rose from around $10 per share in 2003 to over $200 per share by 2008. Over the next decade, Apple continued to innovate and launch successful products, with its stock reaching a new high of over $230 per share in 2018.

Current State of Apple Stock

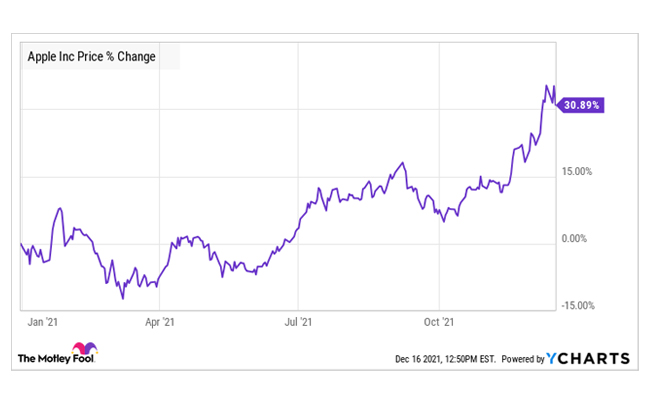

As of September 2021, Apple’s stock is trading at around $148 per share, giving the company a market capitalization of over $2.4 trillion. Apple is one of the most valuable companies in the world and a member of the exclusive trillion-dollar club along with other tech giants like Amazon and Microsoft.

One of the reasons for Apple’s continued success is its ability to generate massive profits. In 2020, Apple reported a net income of over $57 billion on revenues of $274.5 billion. Apple’s profit margins are consistently high due to the premium pricing of its products and the company’s focus on higher-end markets.

Factors That Impact Apple Stock

There are several factors that can impact the price of Apple’s stock, including:

- Product launches: Apple’s stock tends to rise in anticipation of new product launches, as investors expect these products to drive revenue growth and profits.

- Sales and revenue: Apple’s stock price is heavily influenced by its sales and revenue figures, which are closely monitored by investors and analysts.

- Competition: Apple faces intense competition from other technology companies, particularly in the smartphone market. If competitors release products that outperform Apple’s offerings, this can negatively impact the stock price.

- Macroeconomic conditions: Economic conditions such as interest rates, inflation, and GDP growth can impact Apple’s stock price. For example, if interest rates rise, this can make Apple’s high-priced products less affordable for consumers, leading to lower sales and potentially lower stock prices.

- Legal and regulatory issues: Apple has faced several legal and regulatory issues over the years, such as antitrust investigations and patent disputes. These issues can impact the company’s financial performance and stock price.

Conclusion

Apple’s stock is an important player in the stock market, closely watched by investors and analysts around the world. The company has a long and successful history, with its stock price rising significantly in recent years thanks to its ability to generate high profits and launch successful products. While there are factors that can impact Apple’s stock price, the company remains a major player in the technology industry, with a loyal customer base and a focus on innovation and excellence.

![]()