Start Investing Today in Stock Market: Investing in the stock market can be the most effective way to grow your wealth over time. However, diving into stocks can feel overwhelming if you’re a beginner. The good news is that you don’t need a lot of money or a deep understanding of complex financial terms to get started.

Understand the basics of the stock market

Before you start investing, it is essential to have a basic understanding of how the stock market works. At its core, the stock market is a place where investors buy and sell shares of publicly traded companies. When you buy a share of a company, you own a small part of that business. The price of those shares may increase or decrease based on the company’s performance and other market factors.

Key concepts to know:

- Stocks (equities): A type of security that represents ownership of a company.

- Stock Exchange: A market where stocks are bought and sold (eg, New York Stock Exchange, NASDAQ).

- Dividend: A portion of a company’s earnings distributed to shareholders.

- Market Capitalization: The total value of a company’s outstanding shares.

Set clear financial goals before Start Investing Today in Stock Market

Before you invest, decide why you are investing and what you want to achieve. Do you want to increase your wealth for retirement, buy a home or finance your children’s education? Knowing your goals will help shape your investment strategy and risk tolerance.

Ask yourself:

- How much money can I invest today?

- What is my investment time horizon (short-term vs long-term)?

- How much risk can I take?

Build an emergency fund first for Start Investing Today in Stock Market

Make sure you have an emergency fund set aside before putting any money into the stock market. This fund should cover 3-6 months of living expenses and act as a financial cushion for unexpected events such as job loss or medical emergencies. The stock market is volatile, so you don’t want to be forced to sell stocks at a loss to cover emergency expenses.

Decide how you want to invest

- A Private stock

If you want to pick your stocks, you need to research companies and buy shares that you believe will perform well. It requires more time and knowledge but can be rewarding if you choose wisely. - b. Exchange-Traded Funds (ETFs)

ETFs are a great way to invest in a broad range of stocks without picking individual companies. ETFs combine a variety of stocks into a single fund, making it an easy way to diversify your portfolio. - c. Mutual funds

Similar to ETFs, mutual funds collect money from many investors to invest in a collection of stocks, bonds, or other assets. Professionals manage these funds and are another great option for new investors. - d Robo-advisor

If you prefer a hands-off approach, consider using a robo-advisor. These automated platforms create and manage a diversified portfolio for you based on your financial goals and risk tolerance.

Open a brokerage account

To start buying and selling stocks, you need to open an account with a brokerage firm. A brokerage account gives you access to stock exchanges where you can trade.

Things to look for in a brokerage:

- Low or zero trading fees

- Easy-to-use platform (especially for beginners)

- Educational resources and tools

- Access to different types of investments (stocks, ETFs, mutual funds)

Some popular online brokerages include Charles Schwab, Fidelity, E*Trade, and Robinhood. If you prefer to use a robo-advisor, platforms like Betterment and Wealthfront can manage your portfolio automatically.

Start small and diversify

As a beginner, start by investing a small amount that you feel comfortable with. One of the key principles of investing is diversification – spreading your money across different stocks or assets to reduce risk. You don’t want to tie up all of your investments to one company or industry. ETFs and mutual funds are great ways to diversify instantly because they include multiple stocks.

Understand the costs and risks

Investing is not without risk, and the stock market can be volatile in the short term. Stock prices fluctuate, and it’s important to be patient, especially during market downturns. Keep a long-term perspective and avoid making emotional decisions based on market movements.

You also need to understand the costs associated with the investment:

- Trading Fees: Some brokerages charge fees for buying and selling stocks.

- Expense Ratio: Mutual funds and ETFs charge a small fee for management, known as the expense ratio. Low expense ratio is good for long-term investors.

- Taxes: When you sell a stock at a profit, you may pay capital gains tax. Factoring taxes into your investment strategy is important.

Be consistent with regular contributions

The best way to build wealth through investing is to be consistent. Set up an automatic transfer from your bank to your brokerage account, contributing a fixed amount each month This strategy, known as dollar-cost averaging, helps you buy more shares when prices are low and fewer shares when prices are high, averaging your costs over time.

Monitor your investments but don’t overreact

While it’s important to test your investments periodically, don’t get caught up in the day-to-day fluctuations of the market. Successful investors focus on long-term growth rather than trying to time the market. Be informed about your investments, but avoid making hasty decisions based on short-term market swings.

Keep learning and improving

The stock market is always changing, and there is always something new to learn. Continue to educate yourself as you become more comfortable with investing. Read financial news, follow market trends and stay up-to-date on company earnings and economic data. The more you learn, the better your investment decisions will be.

Final Thought

Starting to invest in the stock market is an exciting step towards financial freedom. By understanding the basics, setting clear goals, and being consistent, you can start building a portfolio that works for you. Remember that investing is a marathon, not a sprint, so be patient and let your investments grow over time.

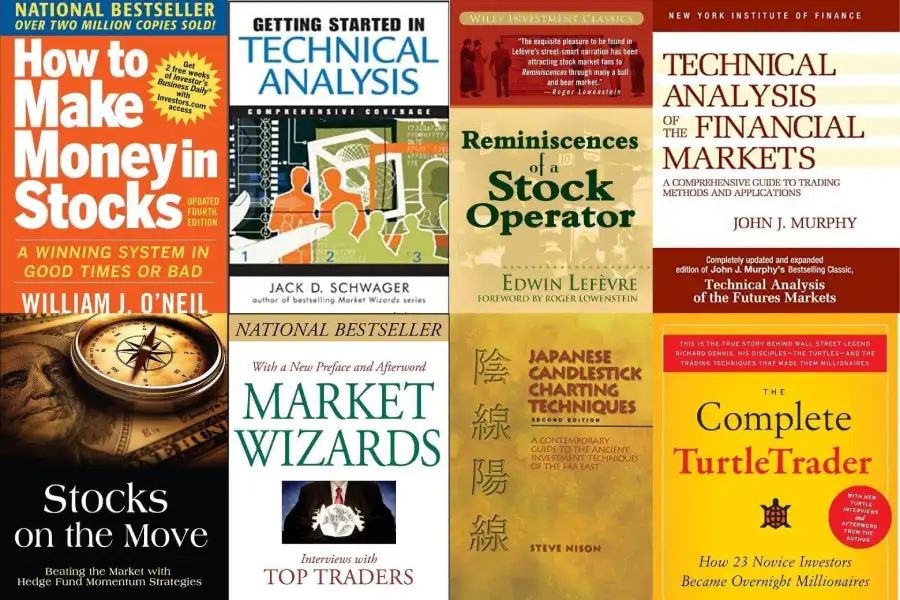

Read Also: Best Stock Market Books

![]()

One thought on “How to Start Investing Today in Stock Market”