The Goods and Services Tax (GST) has transformed India’s indirect tax structure by unifying various state and central taxes into a single system. Understanding how GST return works is essential for every business owner, freelancer, or professional registered under GST. A GST return is a document containing details of sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax). Let’s explore how it works in 2025.

1. What is a GST Return?

A GST return is a statement filed by registered taxpayers to declare their income from business operations. It helps the government calculate the exact amount of tax liability. There are different types of GST returns depending on the taxpayer category — regular taxpayers, composition dealers, and e-commerce operators.

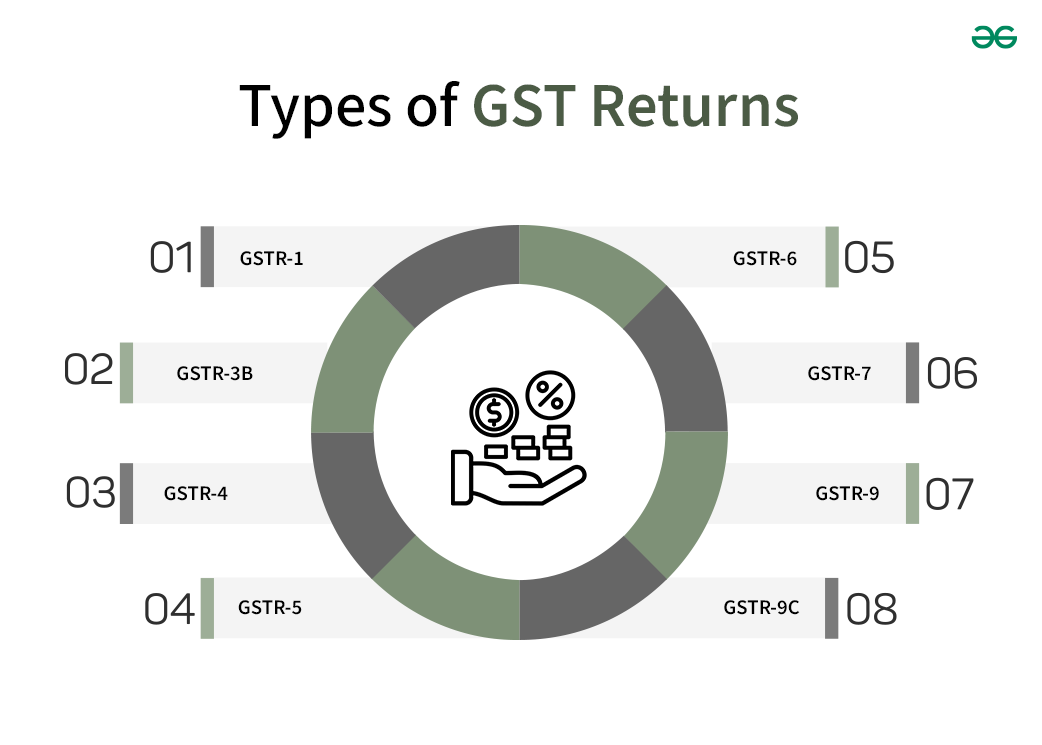

2. Types of GST Returns

The GST system includes various return forms:

- GSTR-1: Monthly or quarterly statement for outward supplies (sales).

- GSTR-2A/2B: Auto-generated statement of inward supplies (purchases).

- GSTR-3B: Summary return of sales, purchases, and tax payments filed monthly.

- GSTR-9: Annual return containing consolidated details of the entire financial year.

- CMP-08: For taxpayers registered under the composition scheme.

3. Process of Filing GST Returns

The GST return filing process involves the following steps:

- Collect Transaction Data: Gather all invoices for sales and purchases.

- Login to the GST Portal: Visit www.gst.gov.in and log in using your GSTIN.

- Prepare and Upload Details: Enter sales and purchase data in relevant forms or use offline tools.

- Claim Input Tax Credit (ITC): Match your purchase data (GSTR-2B) with suppliers’ details to claim ITC.

- Pay Tax Liability: Adjust ITC against output tax, and pay the remaining amount through online payment or challan.

- Submit Return: File the return electronically using a digital signature or OTP verification.

4. Importance of Timely Filing

Timely filing of GST returns ensures compliance, helps claim ITC accurately, and prevents penalties. Late filing attracts interest and fines under GST law, which can affect a business’s credibility and cash flow.

Understanding how GST return works is crucial for smooth business operations. It not only ensures compliance but also improves transparency and financial management. With automation tools and AI-powered accounting systems in 2025, GST filing has become simpler, faster, and more accurate, helping businesses stay compliant effortlessly.

What is Reverse Engineering and How It Works?

Oscommerce Ecommerce Website Development

![]()